Every manager has faced the disappointment of assigning a task to a team member and finding out that the task was ignored or slipped through the cracks.

Insights: Management

So your company has recently taken a close look at its strategy and developed a new plan for the coming year. Now, how do your move your team into execution mode?

Why are we so often caught reacting to an interminable sequence of crises that seem to reoccur more often than they should?

We have all heard the stories of startup “unicorns” — the unlikely heroes of the Silicon Valley tech boom that have reached or exceeded a $1 billion valuation.

Why is it that 61% of all technology projects fail at the point of implementation (as found in a Merkle Group survey)?

It seems like the tech industry and startups are always bragging about their ability to “disrupt” established industries.

Culture is one of the most central features of a company, and almost all executives (84% from a Deloitte study) believe that it is crucial to determining success.

The Harvard Business Review recently released an article outlining how to identify high-potential employees.

The North Texas Auto Group is one of the premier car dealerships of the greater Dallas area.

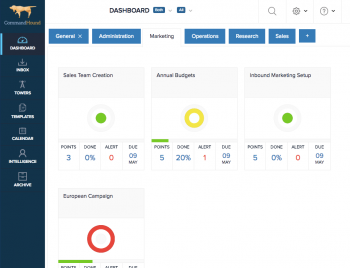

Here at CommandHound, we consider ourselves experts in accountability. As a software company that specializes in making sure things get done, …