Have you ever heard the word “micromanager” used in a positive sense? Neither have I. A micromanager can really suck the joy — and the success — out of a team.

The funny thing is, this kind of manager probably believes that the over-the-top vigilance is a service to the team and to the organization. But no one does his best work when the boss is constantly looking over his shoulder.

Insights: Management

It’s no recent news that BT’s Italian accounting scandal has caused the telecom company’s share value to drop by £8 billion and left 4000 staff unemployed.

PwC’s inability to identify the problems at BT Italia means that in 2018, the accounting company won’t be looking through BT Global’s books for the first time since their IPO 33 years ago.

Headache-causing. Frustrating. Sluggish. These are some of the terms that go through our heads when trying to decode the complex regulatory requirements of Sarbanes-Oxley (SOX).

When business owners and corporate leaders get together, it doesn’t take long for them to bring out the war stories of the difficulty of managing and retaining millennial employees.

We’ve all heard the complaints — They feel entitled to promotion regardless of the quality of their work. They have no loyalty. Their work ethic is sub par. Blah. Blah. Blah.

Have you come to terms with the fact that accountability is the missing element to drive your team to excellence?

Back in the day, I had a work colleague who, if she left the office before 6pm, would leave a cardigan draped over the back of her chair, and her office light on so that it would appear that she only had left her desk momentarily, perhaps to get coffee, but would be working late into the night.

We all knew that the boss was watching us and watching the clock — monitoring who came in late and left early. Time was money, and our time belonged to the company.

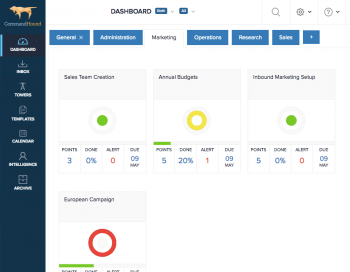

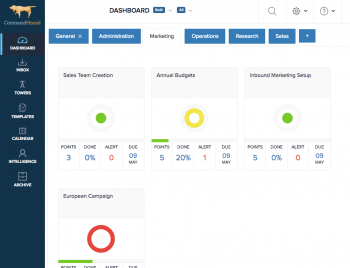

Executives, decision makers, and management in general have a finite amount of “Management Attention Units” (MAUs). So, what are MAUs anyway? We use this general term to refer to time used by management to carry out core supervisory duties. Management’s time – a very valuable and finite commodity.

Why do some employees seem always to get things done on time and as expected, while others struggle? Is it in their DNA? Is it an organizational culture that condones missed deadlines so that some people do not feel the pressure to perform as well? Are incentives, like bonuses, or penalties, like losing a job, accomplishing their objectives?

An audit manager is very much like the captain of a large ship. The captain can’t complete a successful voyage alone; no matter how skillful he is or how much time she has spent on the water.

The captain can chart the course, but each member of the crew must carry out his or her duties and tasks as planned and in a timely manner for the ship to reach its destination safely and on time. One mistake or omission could end in disaster.

The annual performance review is an excruciating ritual that has been around for a really long time, but, in 2017, it’s just not cool anymore.

It is a 20th century model that just doesn’t work for the 21st century. Managers see them as time consuming and not always reflecting employees’ real contributions. Employees, especially millennials, can find them demeaning and unfair.

But how can we provide the feedback that is essential to an employee’s growth without a review? And how can management gather and organize information on employee performance to use in human resources decisions?