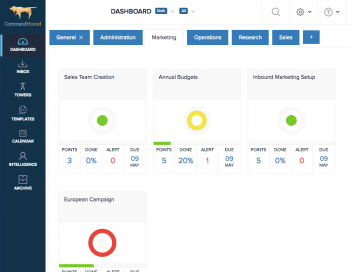

Have you ever found yourself in meetings where the same issues and action items seem to get discussed over and over?

If the mechanics of documenting action items, defining a due date, and assigning it to somebody are in place then, why don’t things get done? Why do we need to talk about them again at subsequent meetings? There are actually some very simple steps you can take to make sure that your meetings stay on track.

Insights: Management

Whether working in an office with fewer than ten people, or a massive corporation with thousands of employees, we have all come across issues of how to hold individual team members accountable for their work.

As projects and teams get larger, more complicated, and less well-defined, it can be increasingly difficult to make sure that team members are staying on top of their own tasks so that the whole project stays on track.

Although CEOs often dictate company culture, and might sometimes even seem above the rules, recent research indicates that company structures are increasingly necessary to monitor upper-level executives and to hold them accountable for their behavior.

Putting practices and strategies in place to hold executives accountable to ethical requirements is necessary and can save corporations many headaches in the long run.

I’ve always believed that accountability is achieved when people feel a sense of belonging and personal pride of being part of a great organization, with great leaders, doing something worthwhile.

Once employees truly buy into the meaning and mission of an organization, all they need is a road map of where the organization is headed, what needs to be done, and when it needs to be completed. With this road map they can see how their work contributes to the overall success of the company.

Expanding the scope of a project is not a bad thing when properly managed. in fact, changing requirements, constraints, needs, context, or priorities in a project is more norm than rarity.

But a problem arises when change creeps into a project unnoticed. When project sponsors, project managers and team members realize that they are working on a bigger and more ambitious project than originally planned, and that they have begun to miss deadlines consistently and to exceed budgets, it’s probably too late.

As a partner, audit manager, or staff accountant in a large accounting firm doing external audits for large public and private companies, you may be wondering how to hold your client accountable for the components of the audit for which the client is responsible.

A recent survey found ISO 9001-certified organizations are 7% more profitable than those that are uncertified.

85% of ISO certified organizations reported increased brand perception, increased demand for products and services, and higher market share.

The June jobs report is out, and it shows that U.S. employers increased the pace of hiring, a sign of continued labor market growth.

U.S. companies didn’t need to see the statistics to know that, in today’s labor market, they must work harder than ever to retain their workers.

And since millennials will make up more than 75% of the workforce by 2030, finding a way to retain that generation of employees is a major concern.

So why write an article about giving your millennial employees negative feedback? Because believe it or not, they want it!

The annual performance review is an excruciating ritual that has been around for a really long time, but, in 2017, it’s just not cool anymore.

It is a 20th century model that just doesn’t work for the 21st century. Managers see them as time consuming and not always reflecting employees’ real contributions. Employees, especially millennials, can find them demeaning and unfair.

But how can we provide the feedback that is essential to an employee’s growth without a review? And how can management gather and organize information on employee performance to use in human resources decisions?

It has become the norm for businesses to incorporate a virtual workforce into their operations.

Whether a company has geographically dispersed offices, hires employees or freelancers in different cities or countries, or just offers local employees the flexibility to work from home, more and more of us are having to manage remote teams.

Results of a Gallup survey published earlier this year showed that 43 percent of employed Americans spent at least some time working remotely in 2016.