A recent survey found ISO 9001-certified organizations are 7% more profitable than those that are uncertified.

85% of ISO certified organizations reported increased brand perception, increased demand for products and services, and higher market share.

Insights: Accountability

A partner in a law firm has a lot to worry about. Business development, client relations, case management, and ensuring high quality work to mitigate the risk of malpractice leave little time for training and mentoring young associates.

Most firms have more work than they can handle, and that work can’t be done without people. It is no secret that retaining associates is one of the biggest challenges facing law firms.

As the manager of a project or of a special company initiative, have you ever been in the position of realizing that nobody is taking the program seriously?

Today’s tight labor market has created an environment where employers are bending over backward to retain their top talent. Companies are looking at pay increases, benefits packages, training opportunities and other perks to keep their employees satisfied and engaged. But they often overlook the most simple and inexpensive way to improve engagement — an employee recognition program.

Why is case and docket management so difficult for lawyers? Isn’t that what they teach in law school?

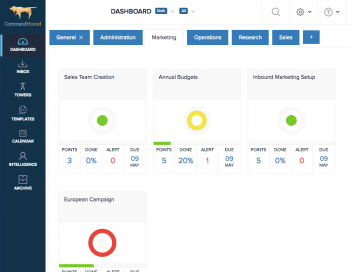

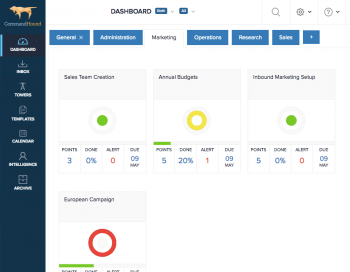

Workflows, Gantt charts, budgets, quality testing, production deadlines, deliverables, risk management — the list goes on. It’s no surprise that project management (PM) is one of the most lucrative professions out there; but with high reward also comes high risk.

The PMI’s 8th Global Project Management Survey found that “For every $1 billion invested in the United States, $122 million was wasted due to lacking project performance.” Another study by The Standish Group, found that “Fewer than a third of all projects were completed on time and on budget over the past year”.

The June jobs report is out, and it shows that U.S. employers increased the pace of hiring, a sign of continued labor market growth.

U.S. companies didn’t need to see the statistics to know that, in today’s labor market, they must work harder than ever to retain their workers.

And since millennials will make up more than 75% of the workforce by 2030, finding a way to retain that generation of employees is a major concern.

So why write an article about giving your millennial employees negative feedback? Because believe it or not, they want it!

The annual performance review is an excruciating ritual that has been around for a really long time, but, in 2017, it’s just not cool anymore.

It is a 20th century model that just doesn’t work for the 21st century. Managers see them as time consuming and not always reflecting employees’ real contributions. Employees, especially millennials, can find them demeaning and unfair.

But how can we provide the feedback that is essential to an employee’s growth without a review? And how can management gather and organize information on employee performance to use in human resources decisions?

What started as a management solution for complex software projects has rapidly grown across industries for companies both big and small.

The agile development process has taken CIO’s, CTO’s and Project Managers to new levels of productivity by embracing a culture of continuous change.

Program Management Offices (PMOs) have had to learn to evolve from a regular hierarchical reporting approach to the continuous change model that business demands today.

It has become the norm for businesses to incorporate a virtual workforce into their operations.

Whether a company has geographically dispersed offices, hires employees or freelancers in different cities or countries, or just offers local employees the flexibility to work from home, more and more of us are having to manage remote teams.

Results of a Gallup survey published earlier this year showed that 43 percent of employed Americans spent at least some time working remotely in 2016.